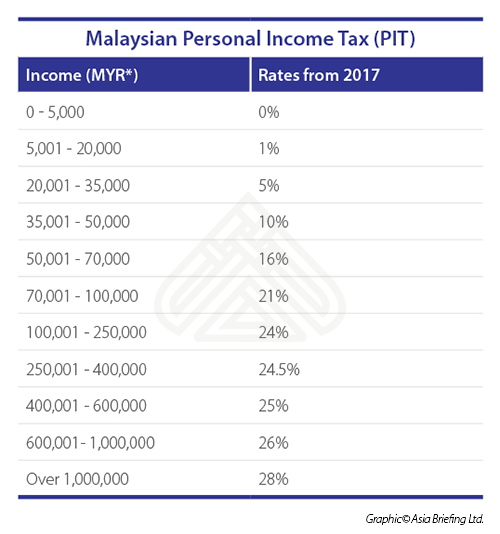

Income tax shall be charged for each year of assessment upon the income of any person accruing in or derived from Malaysia or received in Malaysia from outside Malaysia. The personal income tax with the highest rate is only 27.

Income Tax Malaysia 2019 Calculator Madalynngwf

Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system.

. 13 rows An individual whether tax resident or non-resident in Malaysia is taxed on any income accruing in or derived from Malaysia. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

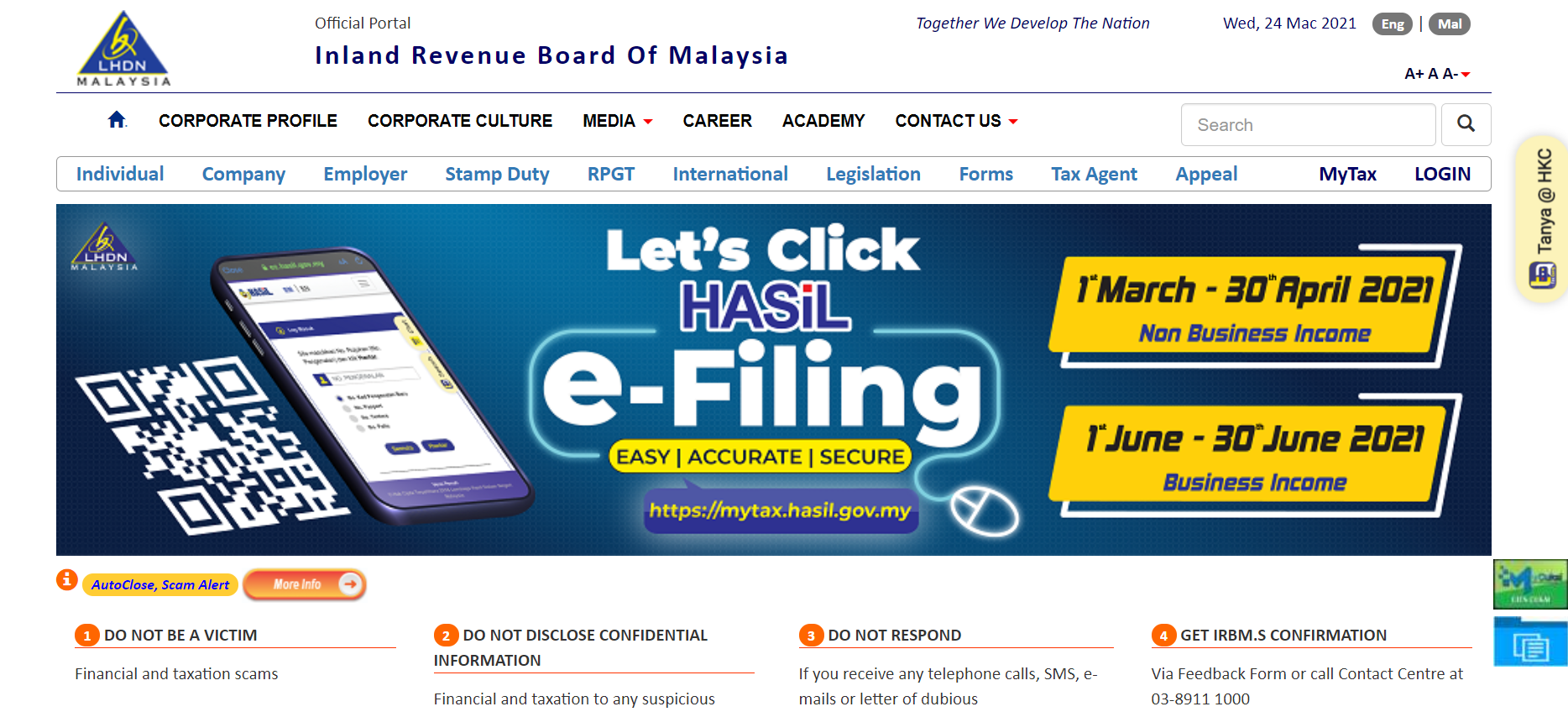

A Gains profit from a business. Individual Income tax. Headquarters of Inland Revenue Board Of Malaysia.

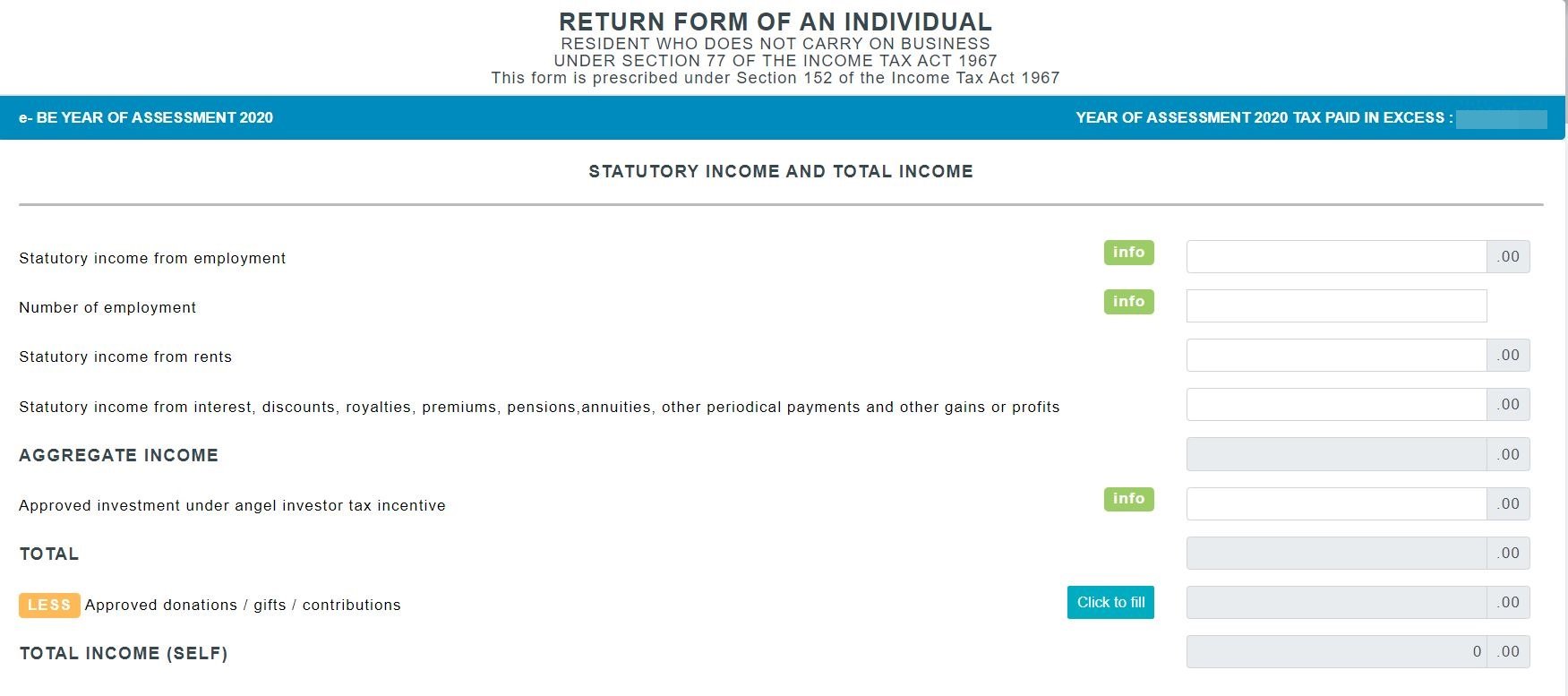

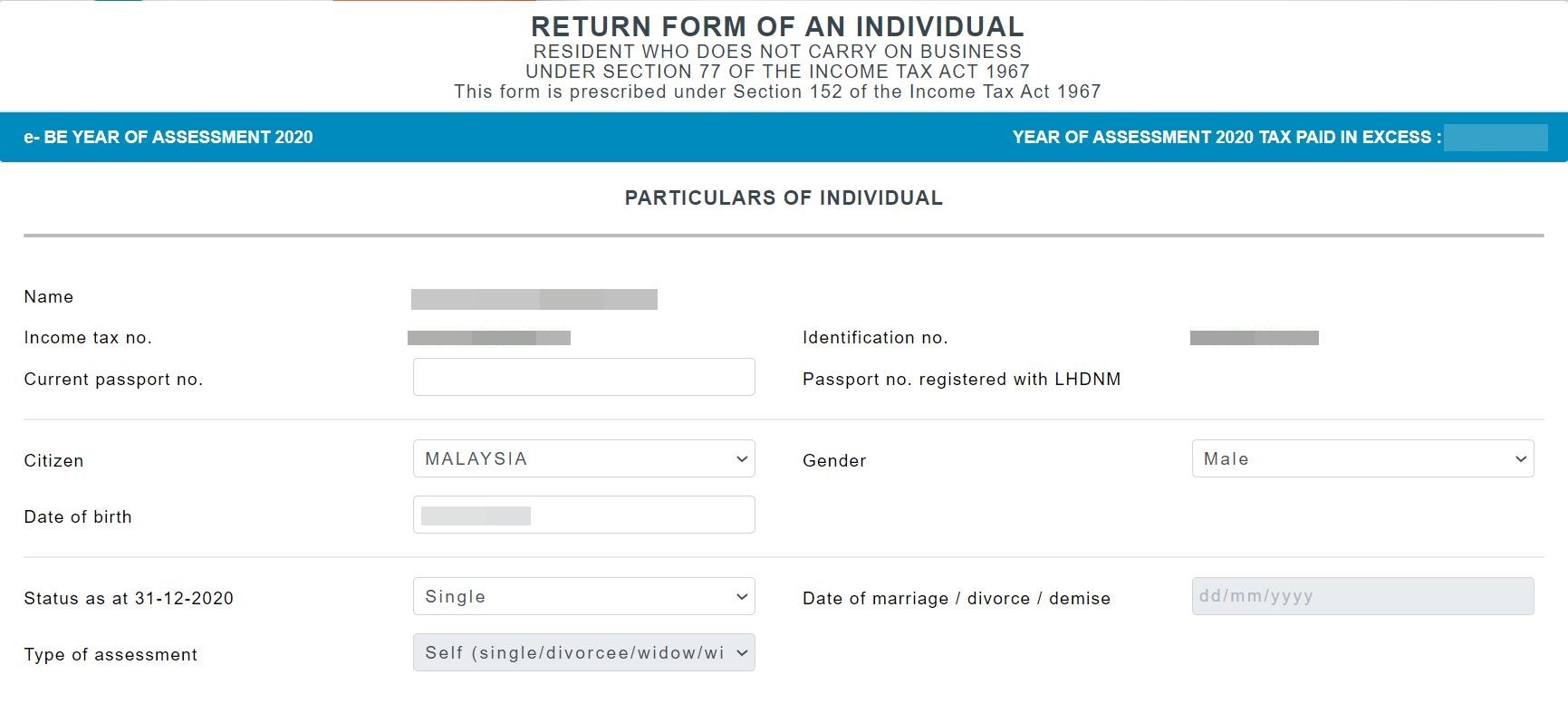

Resident status is determined by reference to the number of days an individual is present in Malaysia. Introduction Individual Income Tax. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

Generally an individual who is in Malaysia for a period or periods. Up to RM3000 for. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

This means that low-income earners are imposed with a lower tax rate compared. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber. Introduction Individual Income Tax.

B Gains profit from employment. Personal income tax rates. Tax is imposed annually on individuals who receive income in respect of.

Agreement with Malaysia and Claim for Section 133 Tax Relief HK-10 InstalmentsSchedular Tax Deductions Paid 46. Also taxes such as estate duties earnings tax yearly wealth taxed or federal taxes do not get levied in Malaysia. Headquarters of Inland Revenue Board Of Malaysia.

Ibu Pejabat Lembaga Hasil Dalam Negeri. Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers. Income Tax Malaysia 2018 Mypf My Irs Announces 2017 Tax Rates Standard Deductions Exemption Amounts And More.

Individual - Other tax credits and incentives. Expatriates working in Malaysia for more than 60 days but less than 182 days are considered non-tax residents and are subject to a tax rate of 30 percent. Resident individuals are eligible to claim the following tax rebates which are to be deducted from tax charged.

For the BE form resident individuals who do not carry on business the. Any excess is not. Regardless of nationality those eligible to claim tax residency Malaysia has a progressive individual income tax system where tax rates rise with.

An employee is taxed on employment income earned for work performed in Malaysia regardless of where payment is made. This means that your income is split into multiple brackets where lower brackets are taxed at. RM9000 for individuals.

Individual Income Tax In Malaysia For Expatriates. C Dividends interest or discounts. The calculation of individual threshold of non taxable income is taking into account after the deduction of annual gross income with eligible individual reliefs and tax rebates.

Its faith in them to assess and settle their income tax with the.

The Complete Income Tax Guide 2022

Malaysian Personal Income Tax Pit 1 Asean Business News

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

10 Things To Know For Filing Income Tax In 2019 Mypf My

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Tiffin Sentul Depot Satisfy Your Seafood Cravings At The Big Feast By Tiffin At The Yard

Individual Income Tax In Malaysia For Expatriates

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

Malaysia Personal Income Tax Guide 2021 Ya 2020

Download Kwsp Income Tax Relief 2019 Gif Kwspblogs

Malaysia Personal Income Tax Guide 2021 Ya 2020

How To Calculate Foreigner S Income Tax In China China Admissions

Malaysian Tax Issues For Expats Activpayroll

7 Tips To File Malaysian Income Tax For Beginners